Harmonic Drawing Tools for Trade Station

Table of Contents

Harmonic Patterns

Introduction

Chart Convention recognition is the elementary and primary ability any dealer develops in Subject area Analysis. It whitethorn be rudimentary development, but the perfection of pattern recognition takes panoptic practice and repetitive exposure. The skilful acknowledgement of patterns helps traders to quantify and react to the dynamic market environment. Chart patterns are categorized into "continuous" and "about-face" patterns, which are encourage sensitive as smooth and complex patterns. The complex patterns structures whitethorn lie of collections of simple patterns and combination of antecedent swings. The knowledge of this classification of pattern recognition and its properties give traders greater potential to react and adapt to a wider range of trading conditions.

Wherefore Practice Patterns Material body?

Market prices e'er exhibit trend, consolidation and ray-trend behavior. They rarely reverse their trends and transitional phases to turn from a previous trend on a single bar. During this transitional phase, they experience trading ranges and price fluctuations. This ranging action defines identifiable price patterns. These consolidation phases occasionally favor frequent trends prior to their shaping and continue their direction. These are called "continuation" patterns. Examples of these patterns include Symmetrical Triangle, Flags and Cup and Handle. Some phases result in a flip-flop of the prior trend and continuing in the new guidance. These are called "reversal" patterns. Examples of these patterns include Head and Shoulders, Double Bottoms and Broadening Patterns.

Harmonic Patterns

The concept of Harmonic Patterns was established by H.M. Gartley in 1932. Gartley wrote about a 5-point pattern (titled Gartley) in his book Profits in the Securities market. Larry Pesavento has improved this pattern with Fibonacci ratios and established rules along how to trade the "Gartley" pattern in his book Fibonacci Ratios with Model Recognition. There are few other authors who deliver worked on this pattern possibility, but the primo bring on to my knowledge is done by Robert Scott Carney in his books of "Harmonic Trading." Scott Carney too invented patterns corresponding "Crab," "Bat," "Shark" and "5-0" and added real depth of knowledge for their trading rules, validity and risk/money management.

The primary theory behind timber patterns is supported price/time movements which adhere to Fibonacci ratio relationships and its symmetry in markets. Fibonacci ratio analysis works comfortably with any market and along whatsoever timeframe chart. The basic idea of using these ratios is to identify key turning points, retracements and extensions on with a series of the swing high and the swing music throaty points. The derived projections and retracements using these lilt points (Highs and Lows) testament give tonality price levels for Targets or Michigan.

Timbre patterns construct geometric convention structures (retracement and project swings/legs) using Fibonacci sequences. These harmonic structures identified as specified (harmonic) patterns offer unique opportunities for traders, such as potential price movements and cardinal turn OR trend about-face points. This factor adds an edge for traders as harmonic patterns attempt to provide extremely trustworthy information connected cost entries, stops and targets data. This may be a key fruit specialisation with other indicators/oscillators and how they work.

Examples of Harmonious Patterns

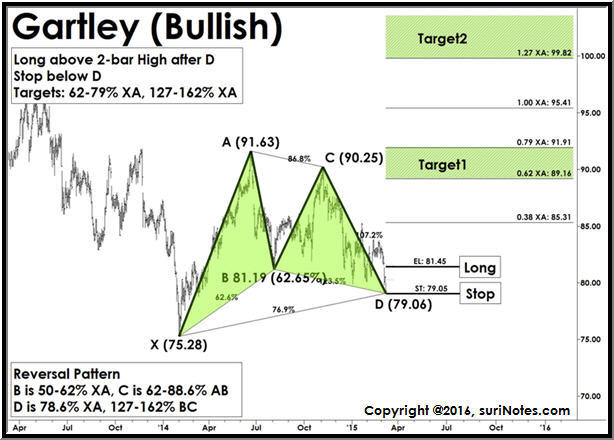

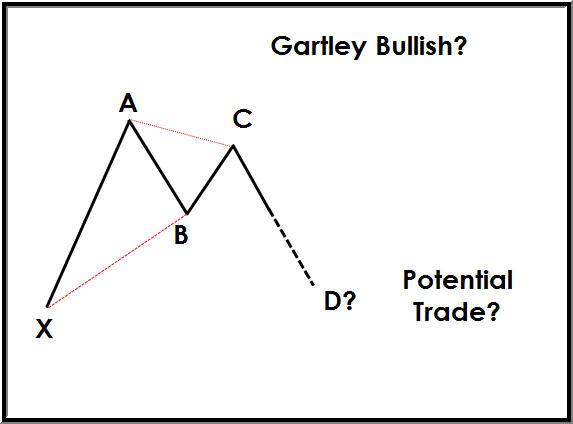

The Gartley rule shown below is a 5-point bullish blueprint. These patterns resemble "M" surgery "W" patterns and are outlined by 5 fundamental pivot points. Gartley patterns are built aside 2 retracement legs and 2 impulse swing legs, forming a 5-dot pattern. All of these swings are interrelated and associated with Fibonacci ratios. The center (eye) of the shape is "B," which defines the pattern, piece "D" is the action operating theater trigger indicate where trades are taken. The pattern shows trade entry, stop and target levels from the "D" level.

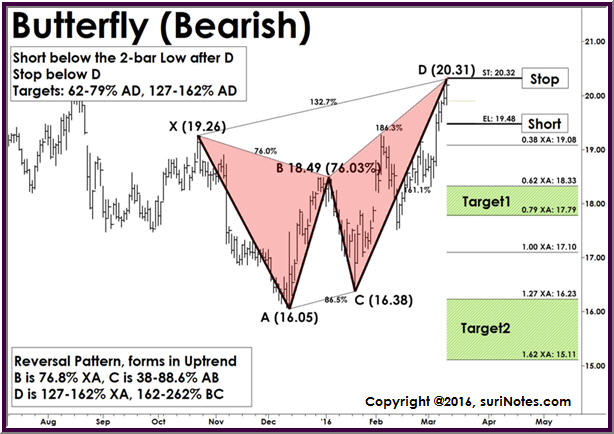

The following chart shows another 5-point harmonic pattern (Butterfly Bearish). This pattern is akin to the above 5-maneuver Gartley pattern, but in reverse. Hither the pattern is "W"-shaped with "B" beingness the center (eye) of the design. The pattern shows trade entry, stop and target levels from "D" levels using the "XA" leg.

List of Harmonic Patterns

-

ABC Bullish/Pessimistic

-

AB=CD Optimistic/Bearish

-

3-Drives Optimistic/Bearish

-

Gartley Bullish/Pessimistic

-

Chat up Bullish/Pessimistic

-

Bat Bullish/Bearish

-

Bellyache Bullish/Bearish

-

Shark Bullish/Bearish

-

Cypher Optimistic/Bearish

Fibonacci Discussion

Any discussion along harmonic patterns essential include Fibonacci numbers, as these patterns use Fibonacci ratios extensively. Fibonacci numbers are pervasive in the population and were to begin with derived aside Leonardo Fibonacci. The basic Fibonacci ratio operating theatre "Fib ratio" is the Golden Ratio (1.618). Fibonacci numbers game are a sequence of numbers where each number is the gist of the premature 2 numbers.

The series of Fib Numbers begin as follows: 1,1,2,3,5,8,13,21,34,55,89,144,233,317,610….

There are plenty of materials and books about the hypothesis of how these Book of Numbers exist in nature and in the financial globe. A list of the most important Fib ratios in the business planetary, which are derived by squaring, square-rooting and mutual the actual Fibonacci sequence, is shown on a lower floor.

Key put down of Fibonacci-derived ratios in trading: 0.382, 0.618, 0.786, 1.0, 1, 1, 2.0, 2.62, 3.62, 4.62

Secondary set down of Fibonacci-plagiarised ratios in trading: 0.236, 0.886, 1.13, 2.236, 3.14, 4.236

On that point are many another applications of Fibonacci in technical analysis. Some of the applications include Fibonacci retracements, Fibonacci projections, Fibonacci Fans, Fibonacci Arcs, Fibonacci Fourth dimension Zones and Fibonacci Price and Time Clusters, among others.

Most trading software packages have Fibonacci lottery tools which can show Fibonacci retracements, extensions and projections. Additionally, Fibonacci numbers game can also be applied to "time" and "price" in trading.

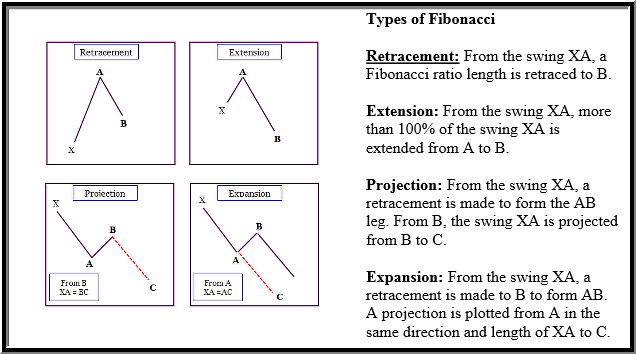

The graphic below illustrates how Fibonacci ratios are used to implement retracement, extension, projection and expansion swings.

Advantages & Disadvantages of Harmonic Patterns

Advantages:

-

Provide future projections and stops advanced, qualification them leading indicators

-

Frequent, repeatable, reliable and produce high probable setups

-

Trading rules are relatively replaceable using Fibonacci ratios

-

Work well with characterized Market Context, Symmetry and Measured Moves rules

-

Work altogether timeframes and in all market instruments

-

Other index theories (CCI, RSI, MACD, DeMark…) can be utilized on with them

Disadvantages:

-

Involved and extremely technical, making IT difficult to understand

-

Correct identification and automation (coding) of harmonic patterns is herculean

-

Conflicting Fibonacci retracements/projections backside create difficultness in distinguishing reversal or projection zones

-

Complexness arises when hostile patterns form from either the same swings Oregon unusual swings/timeframes

-

Risk/reward factors from non-symmetric and low-ranked patterns are pretty insufficient

How to Trade Harmonic Patterns

Pattern Identification

Harmonic patterns can be a little granitic to spot with the naked eye, merely, once a trader understands the pattern structure, they can be relatively easily tarnished by Fibonacci tools. The primary consonant patterns are 5-point (Gartley, Butterfly, Crab, Bat, Shark and Cypher) patterns. These patterns have embedded 3-point (ABC) or 4-point (ABCD) patterns. Wholly the price swings 'tween these points are interrelated and have harmonic ratios based on Fibonacci. Patterns are either forming operating theatre have got accomplished "M"- or "W"-shaped structures or combinations of "M" and "W," in the case of 3-drives. Harmonic patterns (5-point) make a discerning origin (X) followed by an pulsation wave (XA) followed by a corrective flourish to form the "EYE" at (B) complementary AB peg. Then followed by a trend wave (BC) and finally completed by a corrective leg (Four hundred). The faultfinding harmonic ratios between these legs determine whether a pattern is a retracement-based or extension phone-based pattern, as well equally its name (Gartley, Butterfly, Crab, Flutter, Shark, and Cypher). One of the important points to remember is that all 5-point and 4-full point harmonic patterns accept embedded ABC (3-Point) patterns.

Whol 5-point harmonic patterns (Gartley, Butterfly, Crab, At-bat, Shark, Cypher) take similar principles and structures. Though they disagree in terms of their leg-length ratios and locations of key nodes (X, A, B, C, D), once you understand one pattern, information technology will make up comparatively easy to understand the others. It may help for traders to role an automated pattern recognition software to identify these patterns, rather than victimisation the naked eye to find or force the patterns.

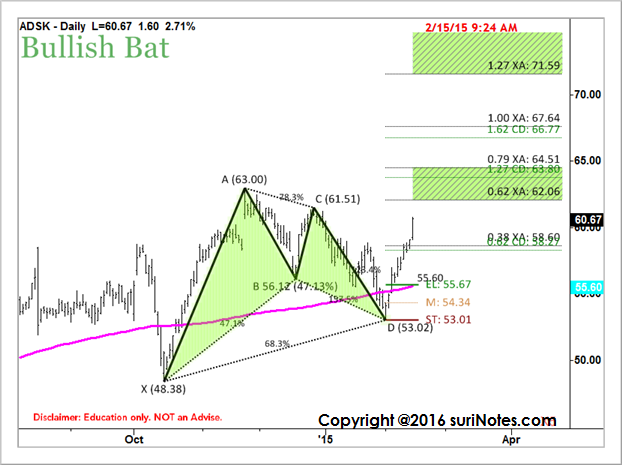

Case: The following graph shows an lesson of the Bullish Cream convention with integrated the First principle Bearish pattern. The identification pivots and ratios are marked on the pattern; the pattern also shows the entry, stopover and target levels.

Trade Identification

In harmonic pattern setups, a trade is identified when the first 3 legs are completed (in 5-point patterns). For lesson, in Gartley Bullish pattern, the XA, AB and Before Christ legs are complete and it starts to form the CD leg, you would identify a potential trade Crataegus oxycantha be in the works. Using the projections and retracements of the XA and B.C. legs, along with the Fibonacci ratios, we can build a price cluster to identify a potential Pattern Completion Zone (PCZ) and D point of the formula.

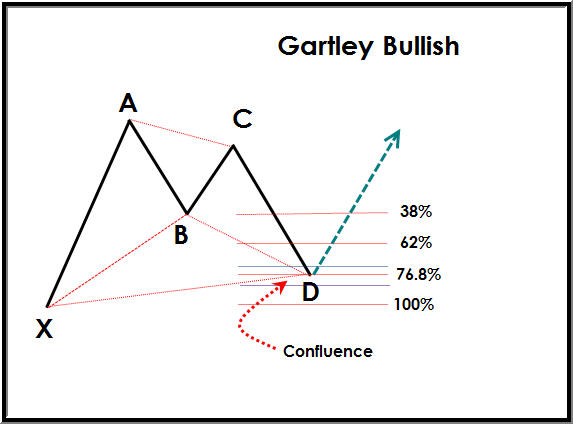

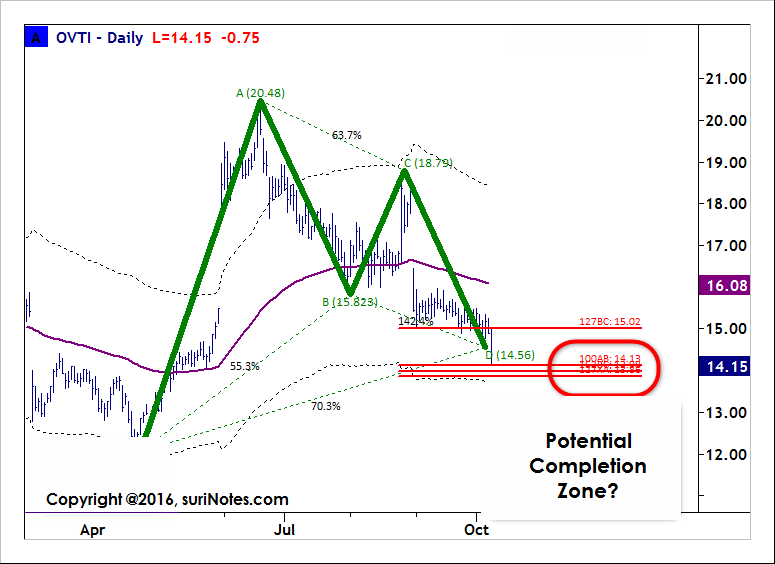

Pattern Completion Zone (PCZ)

All harmonic patterns have defined Pattern Completion Zones (PCZ). These PCZs, which are a.k.a. price clusters, are formed by the completed swing (legs) confluence of Fibonacci extensions, retracements and Mary Leontyne Pric projections. The patterns generally comprehensive their CD leg in the PCZ, then reverse. Trades are expected in this zone and entered happening price reversal sue.

As an example, the Pattern Pass completion Zona (PCZ) for the Optimistic Gartley pattern is constructed using the following Fibonacci extensions and projections:

0.78 XA

1.27 BC

1.62 B.C.

Type AB = Compact disk

Below is an example of idealized Voltage Completion Zone (PCZ) formation:

Below is an example of real-world Potential Completion Zone (PCZ) formation:

Market Context Conditions

Most technical traders use chart analysis with market context concepts to trade. Market context concept is delineated as how current toll is reacting to certain levels (pivots, plunk fo and resistance, MAs), how indicators are performing relative to historic price conditions (like oversold, overbought) and where/how patterns are developing in the current timeframe OR manifold timeframes, etc. Each dealer develops his own grocery linguistic context to trade. One of the dandified ways to define market context is through a Fibonacci Power grid structure. Fibonacci Grid consists of Fibonacci bands (showing price response, trends), pivot levels (to show historic Support/Resistance areas) and Market Structures (to show potential turning points). On any trading graph, Fibonacci Power grid layout is plotted to sympathise how the occurrent price is reacting to the Fibonacci bands and whether the price is exhausted, whether price is trading higher up/below the extreme point bands and whether Beaver State not the Leontyne Price is reacting to the back and resistance levels defined by pivots.

The confluence of these levels in the Fibonacci Grid social structure, along with future pattern structure (and pattern target/stop levels), helps a bargainer bring i a good decision. Pattern trading is rattling precise, as each pattern has specific rules to entry/intercept and targets. When combined, harmonic pattern analysis and grocery store context give a great edge to trade. Harmonic patterns rear fail, only their failure levels are well-characterised and that information is clearly known prior to the trade. Hence, Harmonious pattern trading has many more positives than other trading methods.

Other market context/confirmation conditions and indicators include Divergence, Multiple Timeframes, Fibonacci Bands, Andrew's Pitchfork Analysis, Moving Averages, Pivots, Channels, Trendlines, Volume and Unpredictability.

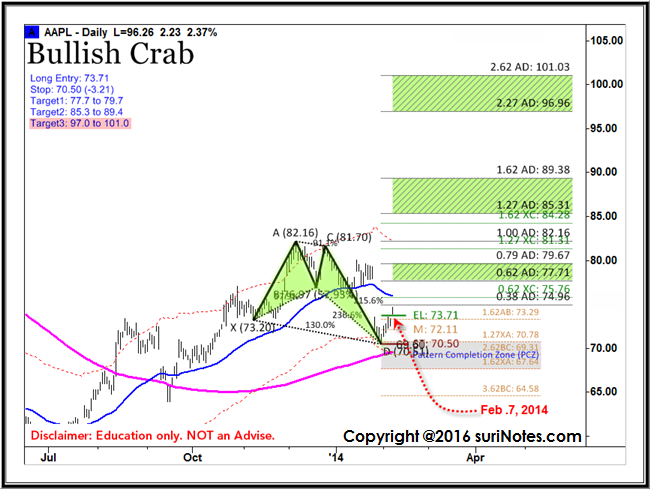

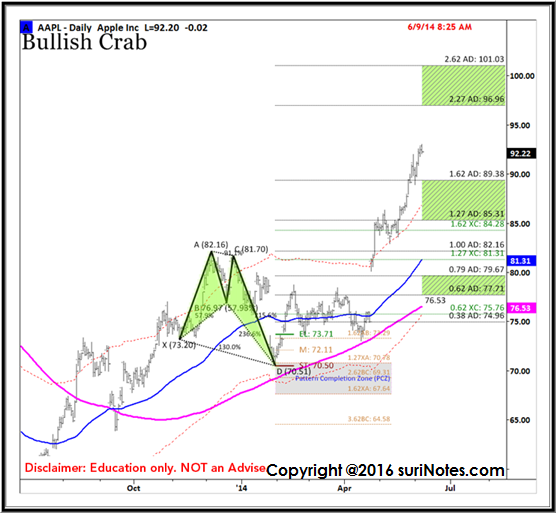

Example: The following example shows how Market Context is used with pattern analysis. This exercise shows AAPL (date: Feb. 07, 2014) forming a Bullish Crab radiation pattern above 200-SMA and remote the Fibonacci Bands (A, C points) and a D point is formed near the lower Fibonacci Bands with Beef pattern. Too, observation the pattern traded down the stairs mid-Fibonacci band level and trading near lower Fibonacci stripe, signaling a potential exhaustion frame-up. After completing Bullish Crab setup, price traded above the EL to signal a Long entry to the setup. The overall trend of AAPL is also bullish, arsenic price slope is confirming above 200-SMA. On Feb. 07, 2014, a Long bullish trade is entered supra 73.71 with a Stop below 70.50 (-3.21). Mark levels are 77.7 to 79.7 for the Target Zone1, 85.3 -89.4 for Target Zone2.

The following chart (June 9, 2014) shows AAPL Optimistic Pubic louse pattern progression and completion of targets.

Trade Entries and Stops

Trading harmonic patterns with computed entry levels are this author's taste rather than trading them blindly at retracement levels or policy change zones advocated by harmonic trading pundits. Most harmonic traders anticipate the pattern to reverse and attempt to trade these patterns in the "flip-flop zone" and end up taking contrarian (counter vogue) trades. To enter a trade, I prefer a confirmation of reversal toll-action combined with a reversal trend change from the "reversal zones."

Just about harmonic pattern deal out entries occur around "D" point inside the reversal zone. Information technology could be a Steal (in bullish patterns) or a Sell (in bearish patterns). Unremarkably, "D" is identified by a confluence of projections, retracements, and extensions of preceding swings (legs), universally called as "reversal zone." In my view, when prices started to reach this zone, it is signaling an opportunity for potential trade, non a signaling to trade up to now. The entry criteria and pattern validity are resolute aside various other factors suchlike ongoing volatility, inherent trend, book structure within the pattern and market internals etc. If the pattern is unexpired and the underlying trend and marketplace internals agreeing with the timbre pattern reversal, then Entry levels (EL) can personify calculated using price-ranges, volatility or some combination. Stop is placed in a higher place/below the last significant pivot (in 5 and 4-Point patterns it is below D for the bullish radiation pattern, above D for bearish patterns).

Target Zones

Target zones in timber patterns are computed based on the retracement, extensions Beaver State projections of impulse/corrective swings and Fibonacci ratios from the natural action point of the pattern structure. For example, in Gartley optimistic pattern, the target zones are computed using the XA leg from the trade action point (D). The projections are computed using Fibonacci ratios like 62% Beaver State 78.6% of the XA leg and added to the action point (D). The denotation ratios like 1., 1.27, 1.62, 2., 2.27 or 2.62 are computed for potential target levels. The special target zones are computed from D, with 62%-78.6% of the XA leg A the first target partition and 127%-162% as the second target zone.

Aim Zone1: (D + XA*0.62) to (D+XA*.786)

Target Zone2: (D + XA*1.27) to (D+XA*1.62)

It is important to note that latent poin zones in tone patterns are computed from a probability stand, not with absolute certainty. Strong money and risk management rules and full working knowledge of the pattern are necessary for whatever convention trading success.

Example: The following chart shows a Bullish Gartley Pattern with an entry level, stops and target zones. The target zones are projecting using XA swing music length and Fibonacci ratios from D. Target Zone 1 comprises the range of 62%-79%, while Target Zone 2 runs from 127% to 162%.

This article was written away Suri Duddella, a personal trader World Health Organization uses proprietorship mathematical and recursive models and pattern recognition methods. For more than information about Suri or to follow his work, sojourn SuriNotes.com or fall into place present.

Harmonic Drawing Tools for Trade Station

Source: https://school.stockcharts.com/doku.php?id=trading_strategies:harmonic_patterns

Post a Comment for "Harmonic Drawing Tools for Trade Station"